The travel industry is increasingly fragmented, full of different players in a very competitive environment; this situation leads to massive restructuring at all levels, disruption of vertical value chains, and “friend-enemies” environments.

What Digital Transformation is really for: Creating New Value

Digital Transformation is hot, no question about that. Every company knows they need a digital strategy. Every competitor is seeking a digital edge. Hundreds, no thousands of companies are out there right now, ready and willing to help you find your digital way. Talent is twice, no ten times more marketable when RPA or AI appears somewhere on the resume. And so we will all march off to become digitally transformed. What that means depends on who you ask.

Ask a room full of leaders from across many industries, both consumers and providers of digital services, and you will get a very wide range of answers, as I did when I posed that very question at an automation conference last week. But there was a common thread in their responses, suggesting a limit to what digital transformation is for – efficiency. Many see digital as just as the newest version of business transformation, supplanting shared services, offshoring, and outsourcing as ways to make work more efficient. Bots, placing their digital “hands” on virtual keyboards will take on all those manual, repetitive office tasks, enabling the elimination of associated costs. Contributing to this perception is the messaging of many Business Process Outsourcing (BPO) and Robotic Process Automation (RPA) companies, positioning their new digital offers as shiny new hammers for the same old cost takeout nails. While there is no question the new digital toolkit can dramatically reduce the cost of human labor associated with business processes, to believe that is mostly what it is for is to largely miss the point.

Ask a room full of leaders from across many industries, both consumers and providers of digital services, and you will get a very wide range of answers, as I did when I posed that very question at an automation conference last week. But there was a common thread in their responses, suggesting a limit to what digital transformation is for – efficiency. Many see digital as just as the newest version of business transformation, supplanting shared services, offshoring, and outsourcing as ways to make work more efficient. Bots, placing their digital “hands” on virtual keyboards will take on all those manual, repetitive office tasks, enabling the elimination of associated costs. Contributing to this perception is the messaging of many Business Process Outsourcing (BPO) and Robotic Process Automation (RPA) companies, positioning their new digital offers as shiny new hammers for the same old cost takeout nails. While there is no question the new digital toolkit can dramatically reduce the cost of human labor associated with business processes, to believe that is mostly what it is for is to largely miss the point.

Driverless cars are amazing not because they eliminate the cost of a human driver, but because of what they liberate humans to do when the car drives itself.

Driverless cars are amazing not because they eliminate the cost of a human driver, but because of what they liberate humans to do when the car drives itself.- A full service mobile banking app is revolutionary not because it eliminates maintenance cost of ATM’s, but because it allows people to do banking transactions anywhere, anytime – expanding services to parts of the globe that have never had that capability before.

- Digital companions like Amazon’s Alexa are not top sellers because they reduce the cost of searching the net for recipe ideas, but because we can now do that while at the stove, preparing dinner, signalling a new era of convenience in the home.

The bottom line is digital transformation is about a lot more than the bottom line.

Company leaders and those looking to start new companies who grasp this insight are focusing on new business models, services and products – and this approach is paying off. “Unicorns,” startup companies valued at $1B or more, like Uber and Airbnb have achieved explosive growth with innovative business models that capitalize on digital business capabilities.

Note that when Airbnb launched in 2008 the technology to book a room online already existed. What was new was the idea that the room or apartment or house was being offered by an owner directly via an easy to use, robust, secure online platform.

Note that when Airbnb launched in 2008 the technology to book a room online already existed. What was new was the idea that the room or apartment or house was being offered by an owner directly via an easy to use, robust, secure online platform.

A challenge for existing firms is can they adopt the startup mindset and open the strategic aperture beyond their existing business models? Can they imagine wholly new offers that while directly flowing from their core competence have the potential to redefine their industry – or will they take the easier course, focusing only on the low hanging fruit of automating out the waste in their existing processes? But it does not have to be a choice between optimize or transform. Why not opt for both, using savings from the quick wins that can be generated through an RPA deployment to fuel next generation efforts in analytics, IoT and AI?

Based on what we hear at conferences on digital transformation, many firms today are launching “random acts of automation,” tempted by the latest tech shiny penny. What is needed is a strategic step back, double-clicking out until the big picture is revealed and new possibilities emerge.

To begin the process of creating a digital transformation roadmap that goes beyond cost reduction, and starts to identify new value creation opportunities, consider three questions:

To begin the process of creating a digital transformation roadmap that goes beyond cost reduction, and starts to identify new value creation opportunities, consider three questions:

- What new services can be delivered based on emerging tech?

- What roles previously reserved to humans can be migrated to digital labor

- What new technology “mashups” create the opportunity for new business models?

Then imagine a future state very different from the way things are done in your industry today – one in which dramatic growth comes from your organization creating new value.

To learn more about how digital transformation is changing our world, join the conversation at The Outsourcing Institute’s Special Interest Group on Digital Transformation Strategies.

OAISS Event Keynote Presentation – The Digital Workforce is Coming: Time to Prepare

Gregory North, Principal, Digital Transformation, Outsourcing Institute

The Digital Age is here and its changing everything about the way we live and work, including the composition of our workforce. Going forward humans aided by new digital capabilities will collaborate with AI “team members” on new products and services, while “down the hall” bots handle all that front and back office work humans used to do. How will these changes disrupt your industry? How prepared is your organization to capitalize on the opportunities presented by the Digital Workforce? It’s time to move on from the questions of how many jobs of what type will be impacted by automation – they all will.

Antonio Ramirez

An entrepreneur first and foremost, Antonio is the founder and UX visionary at Pixel506, bringing together the best of both LATAM and USA markets. Antonio represents the union of the technical and the artistic, focusing on understanding what makes communication work, what the human drivers are, and what builds great brands and businesses. Over the span of his career he has worked with amazing, innovative people at Toyota, Nissan, Bridgestone, Kohler, Budweiser, Quicksilver, Billabong, NYU, Yahoo, APC, HP, Intel, and Microsoft, to name a few. Antonio specializes in branding, business development, and entrepreneurship. Leveraging his knowledge, experience, and innovative spirit, he is constantly revamping brands and creating new experiences with the teams he partners with in the corporate and startup worlds.

Vice President of Digital Transformation and Executive Director of the BPO/ITO/ KPO Chamber at the National Business Association of Colombia (ANDI) interviews IRPA AI Founder, Frank Casale, about RPA and AI, its impacts, and his advice to Columbian business and government leaders.

Vice President of Digital Transformation and Executive Director of the BPO/ITO/ KPO Chamber at the National Business Association of Colombia (ANDI) interviews IRPA AI Founder, Frank Casale, about RPA and AI, its impacts, and his advice to Columbian business and government leaders.

Vice President of Digital Transformation and Executive Director of the BPO/ITO/ KPO Chamber at the National Business Association of Colombia (ANDI) interviews IRPA AI Founder, Frank Casale, about RPA and AI, its impacts, and his advice to Columbian business and government leaders.

Santiago Pinzón Galán: Is this new trend of RPA and AI playing out as you expected?

Frank Casale: Well yes and no. Back in 2014 when I launched The Institute for Robotic Process Automation and Artificial Intelligence I did predict that this would be a game changer and that it was about to take off. That said I’ve been surprised to see that while many outsourcing service providers have moved quickly to invest – the enterprise buyers have moved much slower.

Santiago Pinzón Galán: What is attracting so many companies to automation and AI?

Frank Casale: Regardless of what people tell you 90% of the efforts are driven by cost reduction. Specifically, labor cost reduction. We are talking 20-40% +. This is great news for some. Very dangerous for those in the outsourcing business if they aren’t already embracing this and transforming their business and pricing models

Santiago Pinzón Galán: You coined the term digital labor several years ago. Please explain the term.

Frank Casale: While many see this rapidly growing trend around RPA, intelligent automation and AI as a tech revolution it’s really a reinvention of how work gets done. What started for many organizations as an onshore model two decades ago, then shifted to an offshore near shore labor arbitrage model is now shifting to a no shore model. It software. Very intelligent software that does a good chunk of the work your workforce is doing today. There is only one thing better than inexpensive people getting your work done. And that is no people. So, this is really about a shift from traditional labor and labor arbitrage to what I call digital labor.

Software that replaces people. It’s better faster and cheaper

Santiago Pinzón Galán: What impact do you see this having on outsourcing?

Frank Casale: If you are an outsourcing customer it’s all goodness. You save money , increase speed , quality, analytics and reporting. Your organization is much more effective, nimble and scalable if not elastic. Outsourcing service providers on the other hand are today facing a significant threat to their survival. Their entire business is based on labor arbitrage which is exactly what is being outmoded by digital labor. Some providers will see what is happening, embrace and invest in these new technologies and thrive in this new world of digitally fueled service offerings. These players will experience more growth and profitability than ever before. Others will move too slow and be forced to exit. The market no longer wants or needs a traditional outsourcing service provider. It’s about being a next generation service model. And being a next gen service provider. One just needs to see the many layoffs already taking place among the leading Indian Service providers to see the writing on the wall. It’s about to get ugly.

Santiago Pinzón Galán: What about the nearshore service providers? How will they be impacted?

Frank Casale: Similarly those who hesitate will be in trouble. The providers to ” get it” and pounce on this will do very well. The interesting opportunity for Latham providers is that the right countries and companies will for the first time be able to compete and win quite often against India. With the right intelligent automation and next gen business and pricing model you will be able to consistently out price and out deliver especially for US clients. This could be a game changer.

Santiago Pinzón Galán: What about Colombia specifically what is your advice to business and government leaders here?

Frank Casale: What I really like about Columbia is that a hand full of the govt and business leaders get I and are investing. I sense a real hunger and desire to evolve and lead in this changing market. You can feel it and see it when you are there. If the momentum and the investment continues and the right partnerships and channels are established then Columbia can be a leader in the industry. I’m talking significant business and social impact. This is not just about toolset. It’s about mindset. And Columbia has the right mindset and seems ready to make some big moves.

Visit http://www.andi.com.co/SummitTransformacionDigital/Paginas/agenda.html to learn more about the agenda at the ANDI Conference.

Visit http://www.andi.com.co/SummitTransformacionDigital/Paginas/agenda.html to learn more about the agenda at the ANDI Conference.

To contact Frank Casale directly, please email Frank.Casale@irpanetwork.com

The Second Wave: RPA Lessons Learned – Part 2

In part two of the expert panel discussion in NYC, the former CTO of CompuCom, Unisys and CSC, explores the dangers of random acts of automation. Additionally, top industry experts engage in an open discussion about the best practices and lessons learned in RPA and intelligent automation, based on successes and failures of the the first wave of early adopters.

Moderator – IRPA AI Founder Frank Casale

Panelists – Sam Gross former CTO Compucom, Kevin Kroen Partner PWC, and Chris Surdak Senior Advisor IRPA AI & Author.

Video Interview: Talking Digital Transformation with PwC’s Catherine Zhou

PwC’s Digital Service Leader, Catherine Zhou, joins Outsourcing Institute President, Daniel Goodstein, to examine the shift of digital convergence and its impact within the enterprise.

The interview explores:

- Differentiating Digital vs. Digitalization

- The Change of Business Models Explained in 3 Dimensions

- How to Leverage Traditional Regulatory Items

- The Future of Omni-Channel Customer Care

- Value of Arbitrage – People, Process & Technology

PwC is sponsoring the Digital Convergence Conference on September 27th at PwC in NYC. We will discuss these topics and more! To learn more about the key topics we’re exploring, click here. Please note that buyers can attend for free. Register hereThis theme is by this phentermine online website buyphentermineonline375.com where you can learn about how phentermine works and if you are able to buy phentermine online

Search for new revenue in financial services

US financial institutions are finding it harder to secure new sources of revenue. Growing the top line is challenging as consumers grow accustomed to paying little or nothing for products and services. Banks, asset and wealth managers, and insurers are scrambling to find new ways to grow: organically, by introducing new services, through acquisitions, or by developing strategic partnerships.

A look back

I’d love that. Is it free? Customers are only willing to pay for services that truly create value for them. Inspired by their experience with other, advertising supported businesses, they’ve come to expect most services for free. They also want interactions to be effortless, personal, and fast.

Plugging into FinTech and InsurTech. FinTech startups really “get” their customers, often spotting needs and wants that previously went unrecognized. And they often reach those customers in fundamentally different ways. They have created new product categories, thanks to a growth in enabling technologies like mobile, cloud, and inexpensive storage. For legacy firms, this represents competition—but it also offers opportunity for new revenue streams resulting from increased innovation, partnerships, and acquisitions.

Drowning in data. The financial services industry collects more data on its customers than pretty much any other industry. But, so far, firms have struggled to extract the full value from that data.

Let’s make a deal. From banking to insurance to asset and wealth management, 2016 had a somewhat lower M&A profile than the previous year. But some financial institutions still made strategic acquisitions to consolidate and to acquire technology.

The road ahead

All eyes on the Fed. Competition from startups and other technology players will continue to restrict margins. Even if interest rates rise, margins may not increase very much if customers look elsewhere for higher returns.

Have you truly gone digital? Based on experiences in other industries, consumers of all ages demand a more seamless, personalized experience from their financial institutions. Digital isn’t just a delivery channel issue. Leading financial institutions will use digital tools to discover unmet needs. To do this, they will commit to strategic investments that let them understand how to meet those needs.

Taking advantage of data. We’ll see leading firms analyzing structured and unstructured data to anticipate what will happen next rather than reacting to what already happened. This changes everything—from fighting fraud to preventing insurance losses to spotting new sources of revenue.

Working, together. The underlying conditions for M&A activity will remain in place in 2017, but we also expect firms to invest in developing alliances, partnerships, and joint ventures. These other business relationships can make it easier for them to address client needs more quickly. Some insurers may look to divest to escape a SIFI designation, and we expect an active private equity environment.

What to consider

Go where the customers are. Financial institutions should become part of the daily lives of their users. If you’re targeting customers who want to achieve financial fitness, for example, you should provide products that bundle advice with reviews and service. You should also make interactions fun and rewarding.

Learn from the disruptors. FinTech and InsurTech companies succeed because they solve problems at the heart of the customer’s needs. Once they do, they pivot to offer adjacent services. For example, many payments companies have expanded to lending. It’s a natural extension: they already have the data they need to make smart lending decisions. You should observe how disruptors innovate, and then let it shape your own thinking.

Embrace imperfection. In this market, slow and steady loses the race. Learn to tinker and prototype more effectively, and then find ways to share your experiences broadly throughout your organization. To do this well, you should rethink how you approach business models.

Don’t go it alone. You should stay open to new business models and nontraditional relationships. We expect to see a much greater emphasis on new ways to access and share data, as with open banking and application program interfaces (APIs).

“No one knows what the perfect new business models are because they haven’t been fully articulated or proven. To find sustainable revenue, firms will need to learn fast, fail fast, and partner as needed.”

Customer experience as competitive advantage

Your brand is only as strong as the experiences you create for your customers.

The experience is the message.

The effectiveness of traditional marketing strategies continues to diminish in the face of new technologies, changing customer behavior, and rising customer expectations. The impact of marketing communications has been trumped by the real-life experiences consumers enjoy (or fail to enjoy) when interacting with a brand across the enterprise at every physical and digital touch point.

Indeed, the very definition of brand may be changing. It’s no longer just a logo, or a visual or verbal expression, or even the promise made to customers. A business’s brand is now comprised of the sum total of the actual experiences it delivers.

Experience matters. This five-part series explores the importance and power of customer experience in today’s experience economy. A new installment will be released every few weeks (and added to this page), so be sure to check back for more.

A x-industry framework for CX

Creating and delivering brand-defining customer experiences is a direct result of…

Competition from nontraditional market players in financial services

The rise of financial technology—FinTech or InsurTech, for short—is changing the way people and companies save, pay, borrow, and invest. The environment includes tech companies, infrastructure players, and startups, along with incumbents. The FinTech formula for success is simple: use technology and mobile platforms to slash costs and bypass intermediaries. New competitors often offer low-cost solutions that are simple to access and easy to use. In the process, they’re upending the status quo.

A look back

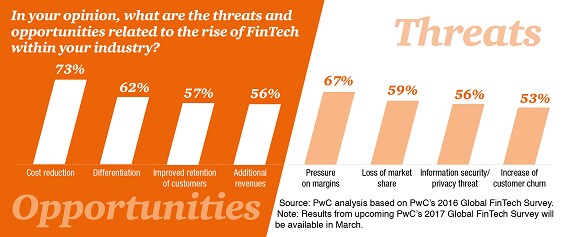

Incumbents take notice. Some incumbents view startups as threats, and for good reason. In our 2016 Global FinTech Survey, respondents told us that they think more than 20% of financial institutions’ business could be at risk to FinTech. But many established firms are also starting to view FinTech as an opportunity. After all, better, faster, cheaper innovation could benefit them as well as their customers.

A year of experimentation. In 2016, incumbents moved away from acquisitions and started to look instead at partnerships with startups. We’ve also seen firms creating proof of concepts and/or working with consortia to enhance operations and improve efficiency.

Regulators trying to strike the right balance. As FinTech and InsurTech gain footholds, regulators and government officials, often led by Asia and Europe, have tried to find ways to encourage innovation in the financial services industry. At the same time, they want to protect consumers and keep risks in check. In the US, the Office of the Comptroller of the Currency (OCC) has proposed a framework for a special purpose national charter for FinTech companies. Regulators at the Consumer Financial Protection Bureau (CFPB), meanwhile, have declared that banks don’t have the right to deny third parties access to customer data if customers want to share it.

The road ahead

The next wave of innovation. In 2017, we expect the footprint of FinTech and InsurTech to continue to expand in many areas including asset and wealth management, capital markets, digital cash, treasury functions, and insurance. We also expect to see growth in digital identity and regulatory technology (RegTech). RegTech typically describes the use of emerging technologies by regulators to help them manage systemic and other risks.

The role of emerging technologies. Blockchain, robotic process automation (RPA), and artificial intelligence (AI)—three of our other Top 10 issues—will also gain ground in 2017. And they are moving so fast it’s hard to keep up. In fact, some companies are hiring people to focus full time on understanding emerging technologies.

Open access. New technology offerings are becoming more integrated into the operating models of many financial institutions. This is being driven by a growing emphasis on application programming interfaces (APIs). More firms are using APIs to let third parties develop apps and tools that can offer customers entirely new services. Of course, cybersecurity will be a concern, too.

Shakeout ahead? A downturn could be the ultimate test for FinTech and InsurTech startups too young to have lived through a full economic cycle. How will they respond if the economy stalls and investments dry up?

What to consider

Embrace digital infrastructure. You will need a digital core supporting an open-API model to integrate FinTech into your operating model. These days, you should link to mobile and desktop users, third parties, back-office systems, and more—securely and seamlessly. Cloud-based infrastructure can help you do this faster.

Open business models require a new way of thinking and working. You should become more agile, planning and delivering more quickly, and partnering with disruptors. But this isn’t just a technology change. You should expect to bring together different skills, talents, and personalities.

Innovation doesn’t just happen. If you want to succeed, you should create a kind of digital “sandbox” to experiment with new ideas and to test out partnerships with other organizations. You’ll need to be willing to fail fast, bring on new partners to work with your platform and data, and learn from your mistakes. And when you decide you’re onto something good, work quickly to bring the idea back to the broader organization.

“In this industry, it can be hard to stay ahead of all the exciting developments. There is a lot going on, and you should be able to quickly decide which technologies and business models really matter. To succeed, you should scan the landscape continuously, filter out what doesn’t affect you, and act quickly when you decide that something is worth exploring.”