The rise of financial technology—FinTech or InsurTech, for short—is changing the way people and companies save, pay, borrow, and invest. The environment includes tech companies, infrastructure players, and startups, along with incumbents. The FinTech formula for success is simple: use technology and mobile platforms to slash costs and bypass intermediaries. New competitors often offer low-cost solutions that are simple to access and easy to use. In the process, they’re upending the status quo.

A look back

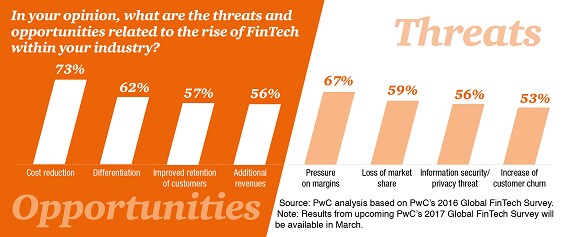

Incumbents take notice. Some incumbents view startups as threats, and for good reason. In our 2016 Global FinTech Survey, respondents told us that they think more than 20% of financial institutions’ business could be at risk to FinTech. But many established firms are also starting to view FinTech as an opportunity. After all, better, faster, cheaper innovation could benefit them as well as their customers.

A year of experimentation. In 2016, incumbents moved away from acquisitions and started to look instead at partnerships with startups. We’ve also seen firms creating proof of concepts and/or working with consortia to enhance operations and improve efficiency.

Regulators trying to strike the right balance. As FinTech and InsurTech gain footholds, regulators and government officials, often led by Asia and Europe, have tried to find ways to encourage innovation in the financial services industry. At the same time, they want to protect consumers and keep risks in check. In the US, the Office of the Comptroller of the Currency (OCC) has proposed a framework for a special purpose national charter for FinTech companies. Regulators at the Consumer Financial Protection Bureau (CFPB), meanwhile, have declared that banks don’t have the right to deny third parties access to customer data if customers want to share it.

The road ahead

The next wave of innovation. In 2017, we expect the footprint of FinTech and InsurTech to continue to expand in many areas including asset and wealth management, capital markets, digital cash, treasury functions, and insurance. We also expect to see growth in digital identity and regulatory technology (RegTech). RegTech typically describes the use of emerging technologies by regulators to help them manage systemic and other risks.

The role of emerging technologies. Blockchain, robotic process automation (RPA), and artificial intelligence (AI)—three of our other Top 10 issues—will also gain ground in 2017. And they are moving so fast it’s hard to keep up. In fact, some companies are hiring people to focus full time on understanding emerging technologies.

Open access. New technology offerings are becoming more integrated into the operating models of many financial institutions. This is being driven by a growing emphasis on application programming interfaces (APIs). More firms are using APIs to let third parties develop apps and tools that can offer customers entirely new services. Of course, cybersecurity will be a concern, too.

Shakeout ahead? A downturn could be the ultimate test for FinTech and InsurTech startups too young to have lived through a full economic cycle. How will they respond if the economy stalls and investments dry up?

What to consider

Embrace digital infrastructure. You will need a digital core supporting an open-API model to integrate FinTech into your operating model. These days, you should link to mobile and desktop users, third parties, back-office systems, and more—securely and seamlessly. Cloud-based infrastructure can help you do this faster.

Open business models require a new way of thinking and working. You should become more agile, planning and delivering more quickly, and partnering with disruptors. But this isn’t just a technology change. You should expect to bring together different skills, talents, and personalities.

Innovation doesn’t just happen. If you want to succeed, you should create a kind of digital “sandbox” to experiment with new ideas and to test out partnerships with other organizations. You’ll need to be willing to fail fast, bring on new partners to work with your platform and data, and learn from your mistakes. And when you decide you’re onto something good, work quickly to bring the idea back to the broader organization.

“In this industry, it can be hard to stay ahead of all the exciting developments. There is a lot going on, and you should be able to quickly decide which technologies and business models really matter. To succeed, you should scan the landscape continuously, filter out what doesn’t affect you, and act quickly when you decide that something is worth exploring.”